By now, it is no secret that momentum ignition has a deep connotation in the stock market. A report from Credit Suisse bank exposes in details how to identify the bad practices in HFT. Keep in mind that while some HFT companies uses Momentum ignition to spark the handle, other algorithmic trading companies are in the hunt for such “ignition”, to handle behind, just as vultures waiting patiently the entire intraday. If you wonder how it works, let’s get into details.

The story of DirtyAlgo

Let’s begin by telling you a little story about a company called “DirtyAlgo”. DirtyAlgo is a small sweatshop algo trading company in Bangladesh who has at its services 10 people, 3 work on infrastructure and the rest are Traders that know how to program in C++. They have invested quite awful time and money developing algorithms, unfortunately they are not that profitable. Then one Trader, lets call him Rajeesh, noticed a strange pattern occuring consintently in the stock market, especially after the crash in 2008. Prices will go up as a burst and in a matter of seconds they will go down, maybe the volume will increase during that period, lasting a minute but after that, the price of the stock will stabilize.

Rajeesh kept on studying these bursts and noticed that he could create a strategy that can benefit from this sudden and unexplainable changes in the price. He noticed how the volume increases , meanwhile the history volatility of the stock hasn’t been that extreme to explain why such as stable price suddenly changes, since there was no external reason for it to happen.

Rajeesh developed his algorithm and started testing his theory. He kept adapting it until he was able to ‘join the hunt’ properly, so he will sell short and buy low at the right moment. He began with small limit and kept on increasing it, making his total PnL one day USD 120,000! Now, you know how he did it? Keep on reading.

Understanding Moment Ignition

As explained in the report “Momentum ignition does not occur in the blink of an eye, but its perpetrators benefit from an ultra-fast reaction time. Generally, the instigator takes a pre-position; instigates other market participants to trade aggressively in response, causing a price move; then trades out. We identify momentum ignition with a combination of factors, targeting volume spikes and outsized price moves “

The market participants: These are other algorithmic trading companies waiting for the ignition or unfortunate victims that might think this is the right moment to handle. The Credit Suisse reports explains how to identify these movements to avoid being victim of this predatory strategy, however some algo-trading companies are in the hunt to become participants in the butchery so they are looking for this movement to handle.

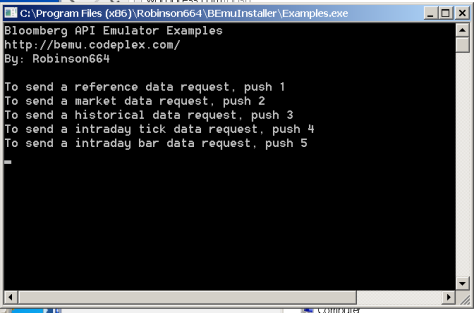

Creating an algo-strategy to wait for the ‘sparkle’

Our mission is not to judge how honest or not is to profit from moment ignition, but to show you how can you also become a vulture in the game.

As described in the report we need to identify

- Stable prices and a spike in volume

- A large price move compared to the intraday volatility

- Reversion

Gather data to analyze volume spikes and outsized price movement

The report was written in 2012, so by now the information regarding the observed pattern might have changed. As described in the report:

“momentum ignition occurred on average 1.6 times per stock per day for STOXX 600 names in Q3 2012, with almost every stock in the STOXX600 exhibiting this pattern on average once a day or more. In addition, we note that the average price move is 38bps (but over 5% are more than 75bps, with some significantly higher – see Exhibit 20), and the time it takes for that move to occur is approximately 1.5 minutes (see Exhibit 21). While 38bps may not sound like a big move, it is a bit more significant when compared to the average duration of these events (1.5 minutes) and the average spread on the STOXX600 (approximately 8bps).

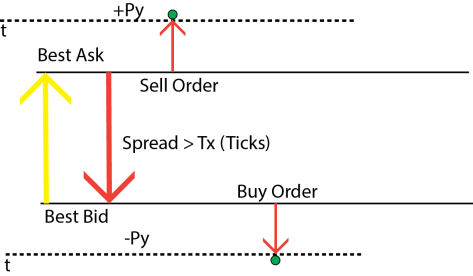

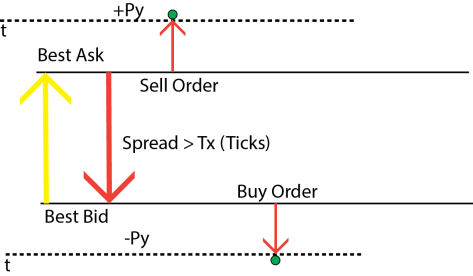

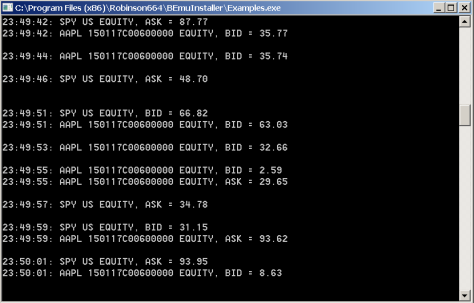

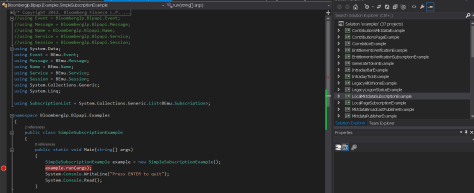

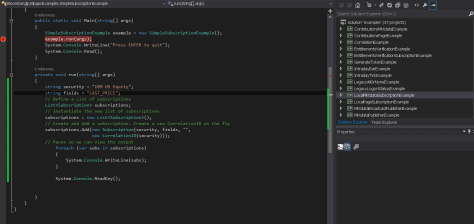

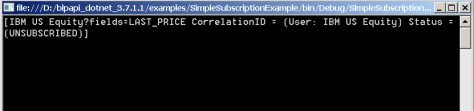

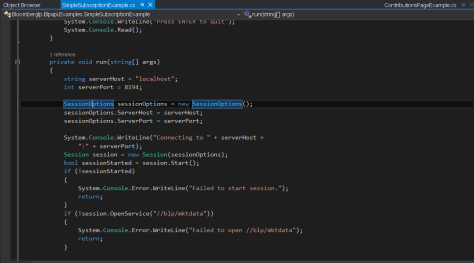

For the strategy to work properly, it is essential to identify a pattern on the movement price and set a best moment/time in milliseconds to buy or sell. Using a Ticking Strategy as our basic strategy, we could determine when to buy or sell after observing the average movements. By keeping no positions, it is essential to calculate the time of the movement (t), the price in correlation to the Best Bid or Best Ask price total in BPS.

Py is the new price after the movement that we want to buy or sell. It is essential to determine the average price movement and the time the move occurs, so you can calculate the moment to sell/buy and get out of there before the volume gets down.

Volume and Volatility are 2 parameters to keep measuring while t(time) is important to trigger the sell or buy action.

Indeed is not that difficult once you understand the movements. The tricky part of creating profit is to calculate the correct BPS and the right time to get out of that position , maximizing your PnL.